Jun 14, 2023 By Susan Kelly

Did you know that it is estimated that homeownership across the United States is at its highest level since 2005? Owning a home can give stability and security to you and your family and offer some financial benefits such as tax breaks.

If you are ready to leap into homeownership, one of the most important things to consider is learning how to apply for a home loan.

This blog post will discuss the essential knowledge needed to understand and properly navigate the mortgage application process. Read on to start saving money on your future mortgage payments!

What to Do Before Applying for a Home Loan

The mortgage application process is not something to take lightly. Before you begin the application, it is important to understand the various costs involved and prepare yourself financially. Here are some key steps that should be taken:

Determine How Much You Can Afford

Start by calculating your income, debt, and other financial obligations. Consider taxes, insurance, and maintenance fees when deciding how much house you can afford.

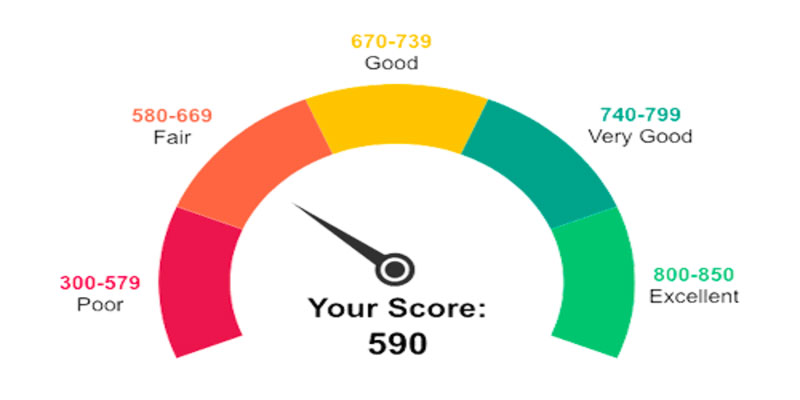

Check Your Credit Score

Before applying for a mortgage, checking your credit score is important. The higher your credit score, the better interest rate you can usually get on your loan.

Do your research

Once you have a better understanding of your budget, it is time to do some research on the different mortgages available. Find out what types of mortgages lenders offer and the interest rates and repayment terms.

Consider asking an experienced lender or broker for help finding the right loan.

Know basic mortgage loan requirements

In addition to your credit score and financial history, there are other basic requirements for mortgage loan approval. Typically, lenders require proof of income or employment verification and a certain amount of money in savings.

By researching and preparing yourself financially before applying for a home loan, you will set yourself up for success. You can save money on your future mortgage payment and make the process as stress-free as possible.

Gather your financial paperwork.

Before you can even begin the application process, having your financial paperwork organized and ready is important. This includes things such as two years of tax returns, bank account statements, pay stubs, credit score information, and any other documents that may be necessary.

Your lender will use this information to assess your loan eligibility and decide on a mortgage rate.

Review your Loan Estimates

After you have completed your loan application, you will receive two Loan Estimate forms from your lender. These documents should be reviewed in detail to ensure that all information is accurate and up-to-date.

Pay attention to any fees or additional costs listed on each loan estimate, as this can affect the overall cost of your loan. Also, compare the estimated closing costs to determine which loan fits you best.

Understand the different types of home loans.

In addition to gathering your financial documents, you must understand the various kinds of mortgages available. The most common type of loan is a fixed-rate mortgage, which has an unchanging interest rate for the entire loan life.

Adjustable-rate mortgages (ARMs) have a fluctuating interest rate and may be beneficial if you plan to stay in your home for a short period. Other loans like FHA and VA loans can provide more flexible terms and lower down payment requirements.

Get pre-approved

Getting pre-approved for a mortgage is an important step in the process. Doing this will give you an idea of how much home you can comfortably afford, and it will also help to speed up the loan application process when you are ready to purchase a property.

Budget appropriately

Once you know how much house you can afford, creating a budget that works for your monthly payments is important. Include all associated expenses, such as property taxes, insurance, and maintenance fees, when calculating your maximum mortgage payment.

Shop around for the best rates

When finding the right home loan, it is important to compare different lenders to find the one that offers you the best terms and rates. Take your time to research and compare different lenders, and don’t be afraid to ask questions about fees or other charges that may not be obvious.

Choose a lender and commit

Once you have chosen a lender, committing to them and moving forward with the mortgage application process is important. Ensure that all your paperwork is in order and that you understand all the details of taking out a loan.

Your lender should also provide prompt and helpful communication throughout the process.

How does the Application Process work?

The application process for a home loan can vary from lender to lender. Generally, you must fill out an online form or provide your paperwork in person.

The lender will then review your information and credit history before presenting you with a Loan Estimate, which is a document that outlines the terms of your loan as well as the estimated costs of closing.

The lender will also process your loan application and provide you with a decision within two weeks or less.

If your loan is approved, the next step is to go through the underwriting process. This involves the lender verifying your financial information and evaluating potential risk factors.

This can take up to 30 days, depending on the lender. Once your loan is approved, the lender will close the loan, and you can move forward with purchasing your home.

FAQs

How can I get a loan for my house?

The process of applying for a loan to purchase a home varies depending on the type of loan you are looking for. Generally, when you apply for a mortgage, you must provide information about your credit and financial history, the property you would like to purchase, and any additional documentation or paperwork required by the lender.

Do I need a down payment?

Most mortgage lenders require that you make some form of down payment to secure a loan. The amount of your down payment will depend on the type of loan you are applying for and other factors such as your credit score.

Conventional loans usually require a minimum 5% down payment, while FHA loans typically require at least 3.5%.

What are closing costs?

When you apply for a loan, certain costs are associated with securing a mortgage, known as “closing costs.” These include fees such as appraisal costs, title search fees, and any applicable taxes.

Generally speaking, closing costs range from 2-5% of the total loan amount.

Conclusion

Applying for a mortgage can be daunting, but you can make it much simpler with the right knowledge and research. Knowing what lenders are looking for, gathering all of your documentation, and understanding the different loan options are all critical pieces of information to have when beginning the home-buying journey. Remember, the more informed you are throughout the mortgage application process, the easier and smoother it will be. Taking these steps can give you peace of mind and save you money when making your monthly payments. Good luck with your home loan application!

-

Accounts Receivable Software Review

Dec 06, 2021

-

A Guide to Selling a House with Solar Panels

Jul 03, 2023

-

Everything you need to know about Cheapest Car Insurance

Jan 16, 2022

-

What Is Short Interest?

Aug 15, 2022

-

These 5 Factors Have Caused Cable TV's Demise

Aug 16, 2022

-

Best Passive Income Apps

Jun 12, 2023

-

Is It Reasonable To Have A Credit Score Of 590?

May 25, 2023

-

How to Make Money on Fiverr

Jun 12, 2023