May 25, 2023 By Triston Martin

A 590 credit score is generally on the lower end of the creditworthiness spectrum. Credit scores serve as a numerical representation of an individual's credit history and help lenders assess the risk of extending credit. While credit score ranges can vary slightly depending on the scoring model, a score of 590 is typically considered fair or poor. With a credit score 590, you may face challenges when applying for loans or credit cards.

Lenders may view this score as an indication of higher risk, which can result in higher interest rates, stricter terms, or even denial of credit. different lenders may have varying criteria for evaluating credit scores, and their thresholds for loan approval may differ. If you have a credit score of 590, it's advisable to improve it by practicing responsible financial habits such as making timely payments and reducing debt.

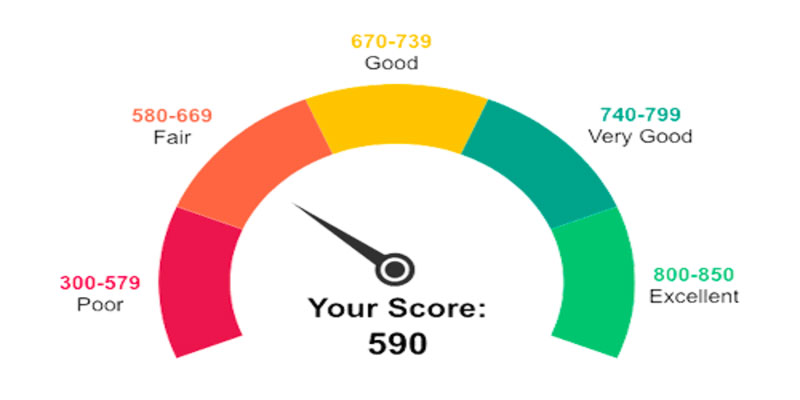

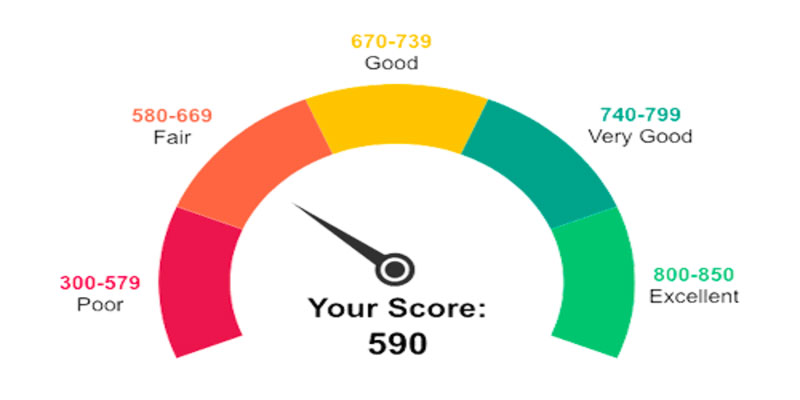

Credit Score Ranges

Credit scores typically fall within a range that can vary slightly depending on the scoring model used. The most commonly used credit scoring model is the FICO® Score, which ranges from 300 to 850. Here's a breakdown of the FICO® Score ranges:

- Excellent: 800-850

- Very Good: 740-799

- Sound: 670-739

- Fair: 580-669

- Poor: 300-579

How To Interpret A 590 Credit Score

Your credit rating is considered "Fair," with a credit score 590, which places you in the middle of the spectrum. This indicates that you have some credit problems or that your credit history might not be extensive. When compared to those with higher credit scores, lenders may perceive persons with a score such as this as being a greater risk. It is essential to remember that different loan providers may use different standards when evaluating a borrower's credit score and other cutoff points when deciding whether or not to approve a loan application.

Influence On The Acceptance Of Loan Applications

If your 590 credit score loan or lower, you may need help to qualify for certain types of credit or loans. Creditors may be more hesitant to give credit, and even if your application is accepted, you might have to agree to more stringent terms, pay higher interest rates, or pay additional costs. It is best to work towards raising your credit score to raise the likelihood that you will be approved for a loan and to ensure that you will have access to more favorable loan terms.

Factors Affecting A 590 Credit Score

Credit scores are influenced by various factors, including:

- Payment History: Late payments, defaults, or accounts in collections can significantly impact your score.

- Credit Utilization: High credit card balances relative to your credit limits can negatively affect your score.

- Length of Credit History: A shorter credit history may result in a lower score.

- Credit Mix: A diverse mix of credit accounts (e.g., credit cards, loans) can positively impact your score.

- New Credit: Opening multiple new credit accounts quickly can lower your score.

Steps To Improve A 590 Credit Score:

While improving your credit score takes time and effort, it's not impossible. Here are some steps you can take:

- Pay Bills on Time: Consistently making on-time payments is crucial for improving your credit score.

- Reduce Debt: Paying down debts can help lower your credit utilization ratio and improve your score.

- Dispute Errors: Regularly check your credit report for inaccuracies and dispute any errors.

- Establish Positive Credit History: One way to establish creditworthiness is to apply for a secured debit card or to become a designated user on an existing credit account.

- Be Patient: It takes time to rebuild credit. Focus on responsible financial habits over the long term.

- It's important to note that credit scores are just one aspect lenders consider when evaluating creditworthiness. Other factors, such as income, employment history, and debt-to-income ratio, influence decision-making.

Conclusion

A credit score of 590 is generally considered on the lower end of the creditworthiness spectrum, falling within the acceptable or poor range. While it's not the worst credit score possible, it can still present challenges when seeking credit or loans. Lenders may view a score of 590 as indicating higher risk and may be cautious in extending credit or offering less favorable terms. It's important to remember that a credit score is not set in stone, and you can take steps to improve it over time. You can gradually raise your credit score by adopting responsible financial habits, such as making timely payments, reducing debt, and building a positive credit history. Improving your credit score is a gradual process that requires patience and discipline. As your credit score improves, you'll have better opportunities for accessing credit at more favorable terms.

-

Can You Use Rent to Pay Your Mortgage

Jul 01, 2023

-

Accounts Receivable Software Review

Dec 06, 2021

-

Top 5 Places for Affordable Retirement Living in Tennessee:

Jul 01, 2023

-

Is It Reasonable To Have A Credit Score Of 590?

May 25, 2023

-

How to Apply for a Home Loan

Jun 14, 2023

-

USAA Bank

Jul 28, 2022

-

Converting Your IRA Into a Health Savings Account

Aug 12, 2022

-

The Best Auto Refinance Loan Offering Companies Of 2022

Dec 07, 2021