Jul 28, 2022 By Triston Martin

USAA is a financial institution that is exclusive to those who are now serving in the armed forces, have served in the armed forces in the past, or have strong family links to someone currently serving in the armed forces. USAA provides customers access to a comprehensive range of financial products and services, including bank and savings accounts, credit cards, and loans for automobiles, houses, and other personal expenses. Members can also manage their financial assets using flexible term certificates of deposit (CDs) that pay a fixed interest rate. The USAA online banking platform enables members to save costs and time with free budgeting tools and online bill payments. Zelle is a mobile banking application that allows USAA members to send and receive money and deposit checks via their mobile devices.

Savings Accounts

The standard USAA Savings Account has a minimum starting deposit of $25 and offers an annual percentage yield (APY) of 0.03%. Because there are no costs connected with this account in any way, not only is it a suitable choice for a linked account that may be used for overdraft protection, but it is also an acceptable location to store some excess cash.

This savings account from USAA allows for mobile check deposits and automated transfers, making it simple to add to your balance. The account's annual percentage yield (APY) used to be tiered in the past, but it has since been lowered to a flat rate of 0.03 percent. This rate applies regardless of the amount of money in the account. Customers of USAA who have both a savings account and a checking account have access to the Savings Booster tools offered by the bank. These tools are intended to assist customers in meeting the savings objectives they have set for themselves. These are the following:

A text-based savings tool that examines your checking account to determine an amount between $1 and $9 may be sent to your savings account. The amount can be transferred manually or automatically. A tool for making recurrent transfers that enables you to choose a portion of a certain recurring direct deposit to be moved automatically to your savings account. A method for getting ATM rebates that transfer the money you get reimbursed for using the ATM into your savings account rather than your checking account. A tax return mechanism that, on an annual basis, puts a predetermined part of your tax refund into an account designated for savings on its own.

Checking Accounts

USAA stands apart from its competitors in several ways, one of which is that two of its three checking accounts pay interest. You will get an annual percentage yield of 0.01 percent on any amount in your USAA Classic Checking account, provided that you retain a daily balance of $1,000 or more in that account, even though this is a rather modest interest rate for a checking account that pays interest, the account more than makes up for it by waiving the majority of its fees and not requiring a minimum balance.

This account is designed to be as easy and affordable to use as much as is humanly feasible. Simply depositing $25 is all that is required to start a Classic Checking account. USAA will transfer money to cover your overdraft in $100 increments for free if you opt for overdraft protection. Connect a USAA credit card or another checking or savings account to your USAA checking account. If you do not pay the overdraft charge or the price for insufficient money, it will cost you $29 total.

USAA Customer Service

USAA has always been recognized for providing exceptional service to its members and customers. You can access a customer service person by phone at least six days a week and seven days a week in certain situations. The days and hours you can reach a customer service agent by phone vary depending on the department of USAA you need to contact. Additionally, if you ever need assistance, you may initiate a live chat session with a website representative.

USAA has always been ahead of the curve regarding the most recent developments in financial technology since it is a banking organization that serves a mobile population. According to an article in the New York Times from 2009, this financial institution was one of the first to implement mobile check deposits, enabling clients to deposit checks using their iPhones. However, when the mobile app is one of the only methods to access your account, some users find it somewhat faulty, especially after installing an update. It may be a source of frustration because it poses a potential security risk.

-

How to Make Money on Fiverr

Jun 12, 2023

-

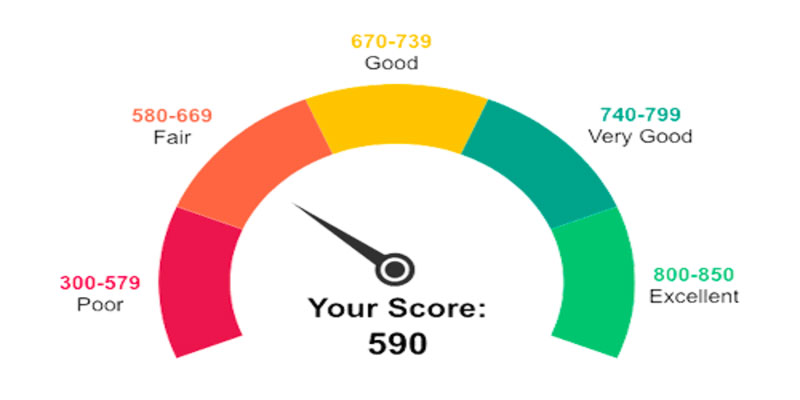

Is It Reasonable To Have A Credit Score Of 590?

May 25, 2023

-

The 5 Biggest Financial Advisory Firms in The U.S. of 2022

Jul 19, 2022

-

Closing on a New House: Obstacles to Avoid

Aug 08, 2022

-

Private Vs. Federal College Loans: A Comparison in 2022

Mar 13, 2022

-

What Makes a Good Realtor

Jul 04, 2023

-

How to Generate Passive Income with No Initial Funds

Jun 11, 2023

-

Best Business Credit Cards For Bad Credit

Aug 25, 2023