Jul 13, 2022 By Triston Martin

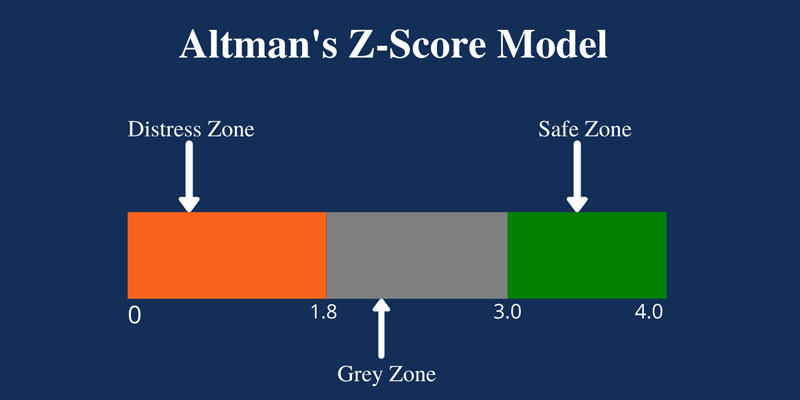

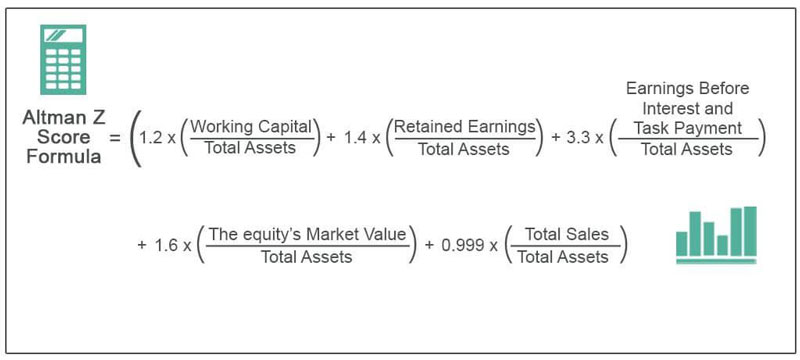

Let’s find the answer of: what is Altman Z-Score? The numerical measurement used to estimate and predict the chances of a company or business going bankrupt in the next two years is known as Altman Z-Score. Simply put, it predicts the likelihood of a company or business bankruptcy. It is a scale from 0 to 4; if the Altman Z-Score result is close to 0, that means the company or business is soon going into bankruptcy; if its result is three or closer to 3, it means that the company is in a very stable economic position.

History of Altman Z-Score

In the 1960s, a student named Edward Altman at UCLA gave an unpopular topic, "Bankruptcy," as his Ph.D. research topic. He combined statistical techniques with financial indicator numbers to predict a business's bankruptcy. He worked on it, wrote on it in 1967, and published his work in 1968. His work started to get recognized as an Altman Z-Score or Altman Z-Score Model.

Altman keeps revaluing his model. From 1969 to 1975, he deeply looked at 86 distressed companies and 110 more from 1976 until 1995. He didn't stop here; from 1996 to 1999, he checked 120 more companies. After checking all of them out, he concluded that the accuracy of the Altman Z-Score lies between 82 to 94%. Now it's been 50 years while using this Model to predict the chances of bankruptcy of a company. He published an up-to-date version of this Model known as Altman Z-Score Plus that allows evaluation of the U.S and non-U.S companies, private and public companies, and non-manufacturing and manufacturing companies. This formula can also be used to predict corporate credit risk and has become a reliable source to measure credit risk.

Explained Version of Altman Z-Score Model

The primary reason for introducing this Model was to predict that a company or business might collapse in the coming two years. This Model proves its accurate predictions about bankruptcy on different occasions. According to the piece study, this Model has shown 72% accurate predictions about the bankruptcy of companies before two years of its occurrence; if bankruptcy predicts one year before, the false-positive level is about 15-20 %.

While creating this Model along with other ratios, Altman, the weighting system that primarily predicts the chances of a company going bankrupt, Altman created a total of three Z-Score Models for different businesses. The one published in 1968 was solely for the public manufacturing companies whose assets are $1 million or more. The private non-manufacturing companies with less than $1 million were excluded from that original Model.

Then the Model he published in 1983 was known as Model A and B Z-Score. They were for small non-manufacturing private companies. In this Model, the predictability scoring system and other variables were also used along with the weighting system.

Altman Z-Score Formula

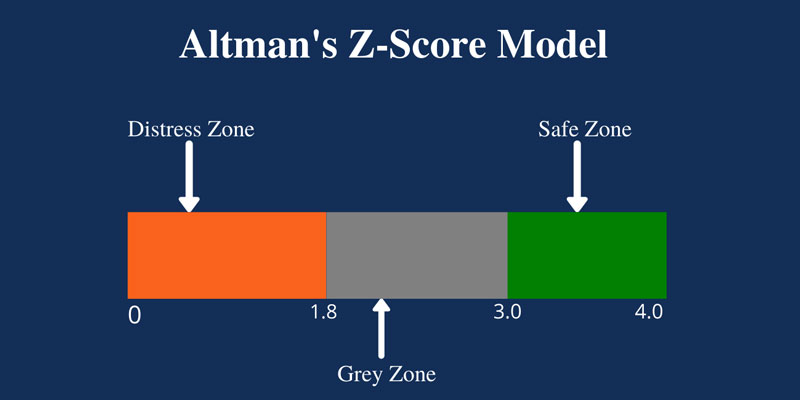

Altman Z-Score can be calculated by using this formula

Altman Z-score = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E

In this formula, A, B, C, D, and E mean this:

- A is equal to the Working Capital / Total Assets

- B is equal to the Retained Earnings / Total Assets

- C is equal to the Earning Before Interest and Tax /Total Assets Ratio

- D is equal to the Market Value of Equity / Total Liabilities ratio

- E is equal to the Total Sales / Total Assets Ratio

The score below indicates that the company is heading for bankruptcy; if the score is above three, it means that the company has solid financial stability. If investors are concerned about a company's financial condition, they use this method before investing or buying the stocks of any business or company. If the result is closer to 3, they may consider buying that company's stock and prefer to sell a stock if the value of Z-Score is near 1.8.

Way to Calculate Altman Z-Score

The Altman Z-Score is based on five different financial ratios. These financial ratios can be calculated from data from the annual 10-K report of a company. The formula of Altman is 1.2 multiple by (Working Capital / Total Assets) + 1.4 multiplied by (Retained Earnings / Total Assets) + 3.3 multiplied by (Earning Before Interest and Tax /Total Assets Ratio) + 0.6 multiplied by (Market Value of Equity / Total Liabilities ratio) + 1.0 multiply by (Total Sales / Total Assets).

Conclusion

For the last 50 years, Altman Z-Score or Altman Z-Score model is helping a lot to determine the chances of running a business or a company going bankrupt. Experts can plan financial strategies to support their companies and prevent them from going bankrupt.

-

Private Vs. Federal College Loans: A Comparison in 2022

Mar 13, 2022

-

Top 5 Places for Affordable Retirement Living in Tennessee:

Jul 01, 2023

-

How Much Are HOA Fees

Jul 02, 2023

-

Can You Use Rent to Pay Your Mortgage

Jul 01, 2023

-

The 6 Great Financial Gifts For Kids This Christmas

Aug 08, 2022

-

Accounts Receivable Software Review

Dec 06, 2021

-

Mastering the Art of Saving for Medical Expenses with an HSA

Aug 28, 2023

-

Converting Your IRA Into a Health Savings Account

Aug 12, 2022