Aug 12, 2022 By Susan Kelly

Did you know you may transfer funds from your IRA to a health savings account (HSA) once without incurring any fees or taxes? The Health Opportunity Consumer Empowerment Act of 2006 authorized this practice, formally known as a qualifying HSA money distribution.

Exactly What Is an HSA for Health Care?

High-deductible health plans are the target audience for a health savings account (HSA) (HDHPs). These plans have yearly deductibles of at least $1,400 for people and $2,800 for families for 2021 and 2022.

For further information about the HSA, consider the following statistics:

- Individuals must spend less than $7,000 in 2021 and $7,050 in 2022.

- In 2021 and 2022, the maximum yearly contribution for an individual is $3,600 ($7,200 for a family), and for a family of four, $7,300.

However, premiums are not considered out-of-pocket expenses, but deductibles, copayments, and coinsurance are. You can contribute to a health savings account before taxes are taken out to lower your taxable income.

Rules for Converting an IRA to a Health Savings Account

Only those qualified to make HSA contributions can roll over IRA assets into a health savings account. Put another way; the transfer must be made when the account holder is enrolled in an HDHP and meets all other requirements for an HSA.

In addition, you must keep meeting HSA eligibility requirements for a full year after completing an IRA-to-HSA rollover. You are obligated to remain in your HDHP until the end of the evaluation period.

You must report the amount you rolled over as income on your tax return if you lose eligibility. There will also be a 10% penalty added to the sum. One lifetime transfer of IRA funds to a health savings account is permitted. The yearly limit on HSA contributions is the maximum amount you may roll over.

Transfers From Existing Accounts

Traditional IRAs

Rollovers from both standard and Roth IRAs to HSAs are permitted. The advantages of a regular IRA make it the better choice for a rollover. Because withdrawals of contributions to a Roth IRA are always free of taxes and penalties, earnings withdrawals are also free of taxes and penalties beyond age 5912.

You can instantly fund your HSA after completing a rollover from a regular IRA for tax-free medical expenses. 2 Your deductible IRA contributions will be rolled over, but your non-deductible ones will stay put. If you can put off spending the rolled-over money until retirement, you'll get a nice tax break. Say you reach 55 and decide to roll over the maximum of $8,000 into a Roth IRA.

401(k) and 457 Plans

One way to put money into a health savings account is to transfer it from another retirement account, such as a 401(k) or 457 plan. To transfer money from one retirement account to another, you must first transfer the Money into an Individual Retirement Account. With the Money in an IRA, you can move it to an HSA once without paying taxes. 3 This is a complex action; you should consult a financial expert before taking it on.

Other Methods of HSA Contribution

You can decrease your tax liability by contributing to a health savings account and a standard individual retirement account (IRA) if you can do so. 210 And your retirement account in the IRA will keep growing. Regular IRA withdrawals can fund a health savings account (HSA) if you're 59 1/2 or older and short on cash.

Withdrawals from a standard IRA and HSA contributions should balance each other in terms of their tax implications. Last but not least, you need not limit yourself to just one go; rather, you may make this an annual tradition if you want.

Example

Person A, under 55 years old, has a family HDHP. In 2022, a donation of $2000 is made. You can access up to $5,300 from your IRA for a one-time transfer. This is because, in 2022, this person's HSA contribution maximum will be $7,300 per year. Individual A's IRA rollover is subject to reduction by any employer HSA contributions made on their behalf.

But if the account person is 55 or older, the HSA contribution maximum increases to $8,300. To calculate the maximum IRA transfer amount, an HSA-eligible individual must deduct their own HSA contributions and employer's HSA contributions.

Conclusion

Anyone eligible for a health savings account (HSA) and who wants to save taxes on Money that might otherwise be taxed at some point in the future may profit by making a one-time transfer to their HSA. If you're thinking about making this switch, you should know that you won't be able to open a new HSA for at least a year after making the switch. As mentioned above, anyone thinking about this course of action should consult a tax expert beforehand.

-

A Complete Review On Avant Personal Loans

Aug 01, 2022

-

What Is Debt to Credit Ratio and Why Should You Care

Jul 01, 2023

-

How to Apply for a Home Loan

Jun 14, 2023

-

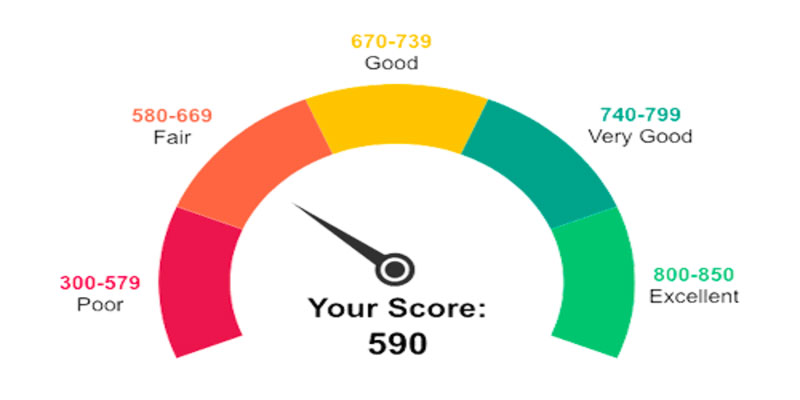

Is It Reasonable To Have A Credit Score Of 590?

May 25, 2023

-

Mastering the Art of Saving for Medical Expenses with an HSA

Aug 28, 2023

-

Everything you need to know about Cheapest Car Insurance

Jan 16, 2022

-

Credit Card Debt Statistics

Jun 16, 2023

-

What Is Business Payroll Service and How to Find Good Payroll Service

Dec 12, 2021