Jul 01, 2023 By Susan Kelly

Are you considering taking out a reverse mortgage but unsure whether it's the best financial move for you and your family? A reverse mortgage can be a great way to tap into the equity in your home if used correctly as part of an overall retirement planning strategy.

To make an informed decision, you must understand the pros and cons of this type of loan. In this blog post, we'll explore what a reverse mortgage is and examine the potential benefits and drawbacks for seniors trying to maximize their savings while living on fixed incomes.

What Is a Reverse Mortgage

Reverse mortgages are loans that let homeowners age 62 and up cash out on the equity in their homes. It makes it possible for seniors to access money without selling their homes or taking out a new loan. The debt may be paid off once the borrower passes away, sells the house, or vacates the home for at least a year.

How Does a Reverse Mortgage Work

For homeowners over 62, a reverse mortgage is a particular kind of financing. Without having to make regular payments or sell their home, they can use it to turn some of the value in their home into cash.

The money can be used for any purpose, such as paying off existing debts, supplementing fixed income sources, making home improvements, or covering medical expenses.

Reverse mortgages are available as lump sums, lines of credit, or a combination. The amount you qualify for depends on your age, home value, and interest rate.

Generally, the older you are and the higher the value of your home, the more money you can receive from this type of loan.

Reverse Mortgage Pros

You can better manage expenses in retirement.

One of the main advantages of taking out a reverse mortgage is that it can help you better manage your expenses in retirement. With this type of loan, seniors can access their home's equity to supplement their monthly income or cover large unanticipated expenses.

This gives seniors more financial flexibility and allows them to stay in their homes longer without worrying about budgeting. Furthermore, since reverse mortgages don't require monthly payments and can be repaid upon the borrower's death or when the home is sold, seniors have more control over their money. This makes a reverse mortgage an attractive option for retirees who want to maintain financial independence while living on a fixed income.

You Can Stay in Your Home

Another major advantage of taking out a reverse mortgage is that it allows seniors to stay home. With the proceeds from this loan, retirees can use the money to cover necessary home repairs and maintenance, thus avoiding costly moves or relocations.

You don't have to pay taxes on the income.

The great thing about reverse mortgages is that you don't have to pay taxes on the income you receive. Since this type of loan is based on your home's equity, it does not count as taxable income and can help retirees protect their savings from tax liability.

Furthermore, since this loan does not require monthly payments, seniors can keep more money in their pockets and enjoy the flexibility of controlling their finances. This makes a reverse mortgage an attractive option for retirees who want to reduce their tax burden while still enjoying financial independence during retirement.

If the sum exceeds the value of your house, you are safeguarded.

One of the greatest advantages of taking out a reverse mortgage is that it can guard against unexpected events in the future. Reverse mortgages are non-recourse loans, meaning that if the loan balance exceeds your home's value, you will not be held personally responsible for paying back any remaining debt.

Furthermore, since these loans are federally insured by the Federal Housing Administration (FHA), seniors can rest assured that their loan is secure and protected against financial loss.

Additionally, reverse mortgages do not require any collateral, so if you find yourself in a difficult financial situation later down the road, your home and other assets will remain safe. This means that even if the market value of your home decreases, you won't be held liable for any remaining debt.

Your heirs have options.

When passing on their assets to their heirs, seniors with reverse mortgages have several options. For example, they can repay the loan in full with proceeds from the home sale or other assets. Alternatively, they can transfer ownership of the home to a family member willing and able to assume responsibility for any remaining debt.

In addition, heirs can negotiate with the lender to assume a new loan that will pay off the balance of the reverse mortgage. In any case, seniors and their families have options for figuring out what to do with the home and its equity after death. With careful planning, retirees can ensure their assets are passed on according to their wishes.

Reverse Mortgage Cons

Your home can be foreclosed.

A reverse mortgage can benefit seniors and retirees but also have major drawbacks. One significant risk associated with a reverse mortgage is the potential of foreclosure if you do not keep up with loan payments.

When taking out this type of loan, it's important to consider all the potential scenarios and plan accordingly to protect your home. Even when managing the loan payments, you may still have to pay for certain expenses such as property taxes and home insurance. If these bills are kept, your home can be foreclosed, and you will retain any money or equity built into the property.

You could need help navigating changes to your status.

When taking out a reverse mortgage, being mindful of your changing status is important. If you move or change employment or marital status, the loan terms can change and become more difficult to manage. Seniors need to consider how these changes could affect their ability to make timely payments and access equity from their homes.

You could inadvertently violate other program requirements.

It's important to know that reverse mortgages can also include other program requirements. For example, if you rely on government assistance such as Social Security, you could inadvertently violate the terms of those programs when taking out a reverse mortgage. This can result in penalties or even loss of benefits.

You can only deduct the interest from your taxes once you repay the loan.

Taking out a reverse mortgage means that the interest accrued from the loan will be tax deductible once it is fully paid off. This can add up to a large amount of money over time, and seniors should consider this when deciding if they want to pursue a reverse mortgage or explore other options.

You have to pay for it.

Reverse mortgages require payments like any other loan, but seniors often find the payments more difficult to manage due to fixed incomes. It is important for those taking out a reverse mortgage to understand their ongoing financial obligations and plan accordingly. Property taxes, home insurance, and loan interest must be paid as part of the agreement to avoid foreclosure.

FAQs

What is a reverse mortgage?

A loan, particularly for seniors, enables homeowners to turn a portion of their home equity into cash.

What are the benefits of a reverse mortgage?

Provides a source of income, enables homeowners to stay in their homes, and offers flexibility in how funds are used.

What are the potential drawbacks of a reverse mortgage?

Possible high costs, reduced inheritance for heirs, and the requirement to maintain the property and pay property taxes and insurance.

Conclusion

A reverse mortgage can be a useful form of financial assistance for some retirees. It has both advantages and drawbacks to consider. Plus, they do not require monthly payments and can free up much-needed funds for seniors on fixed incomes. However, they are complex contracts, and the money must be repaid when the home is sold, or the borrower dies. Weighing out all these factors is critical in deciding whether a reverse mortgage is a good fit.

-

A Guide to Selling a House with Solar Panels

Jul 03, 2023

-

The 5 Biggest Financial Advisory Firms in The U.S. of 2022

Jul 19, 2022

-

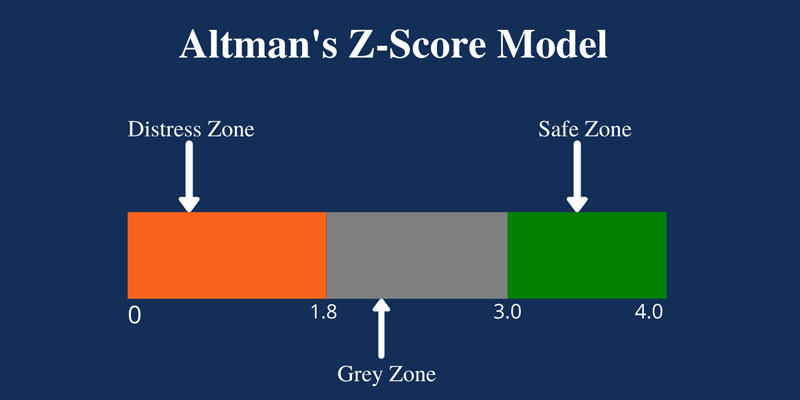

What is Altman Z-Score And How To Calculate It?

Jul 13, 2022

-

10 Must-Know Facts Before Moving to South Carolina

Jun 30, 2023

-

Everything about the Right Amount of Life Insurance

Jan 17, 2022

-

How to Apply for a Home Loan

Jun 14, 2023

-

Kraken Review: Everything You Need to Know

Feb 09, 2022

-

Best Passive Income Apps

Jun 12, 2023