Jun 29, 2023 By Susan Kelly

A direct IRA transfer is a process that allows you to quickly and securely move funds from one retirement account to another, without the need for you to withdraw the money and make an additional deposit. It's a convenient way to make the most of your retirement funds, and understanding the process is essential to maximizing your savings and investments. In this comprehensive guide, you will learn all about how a direct IRA transfer works and what you need to do to get started.

The Basics of Direct IRA Transfers:

To begin, you will need to establish a direct transfer request with your current plan provider or administrator. This involves providing information about the source account and the destination account details. Once this is done, your request will be processed by the institution so that funds can be transferred from one plan directly into another.

Defining Direct IRA Transfers:

Individual Retirement Accounts (IRAs) are a popular investment vehicle for individuals looking to save for their retirement. Within the realm of IRAs, direct transfers are a common method of moving funds between accounts. A direct IRA transfer involves transferring funds from one IRA custodian directly to another, without the account holder ever gaining access to the money.

Analyzing the Benefits of Direct IRA Transfers:

Direct IRA transfers offer numerous advantages for individuals seeking to optimize their retirement savings strategy. Firstly, these transfers allow account holders to seamlessly move their funds from one custodian to another, without triggering any tax consequences or penalties. This ensures that the money remains within the tax-advantaged IRA structure, preserving its growth potential.

Direct IRA transfers enable account holders to diversify their investment portfolios by accessing a wider range of investment options offered by different custodians. This flexibility empowers individuals to tailor their investment strategy according to their risk tolerance, financial goals, and market conditions.

Exploring the Fees and Risks:

When making a direct IRA transfer, it is essential to consider the associated fees and risks. Most custodians charge a processing fee for transferring funds between accounts, so it is important to compare the fees of different institutions to find the best deal. Additionally, some custodians may also charge administrative fees and other charges for account maintenance, so this should be taken into account when making your decision.

Aside from fees, individuals should also consider the potential risks associated with direct transfers. Due to the complexity of the process, there is a chance that mistakes could occur during the transfer, resulting in funds ending up in the wrong account or being lost. To minimize this risk, it is important to choose a reputable institution that has a clear understanding of the process and the necessary safeguards in place to protect your funds.

Investigating the Process for Direct IRA Transfers:

The process of initiating a direct IRA transfer is straightforward. It typically begins with the account holder opening an account with the receiving custodian and completing the necessary paperwork to authorize the transfer. This paperwork often includes a transfer request form and a copy of the most recent IRA statement from the sending custodian.

Once the paperwork is submitted to the receiving custodian, they will coordinate with the sending custodian to facilitate the transfer. The funds are then transferred directly from the sending custodian to the receiving custodian, ensuring a seamless and secure transition.

Examining Investment Options that are Available with Direct IRA Transfers:

One of the key benefits of direct IRA transfers is the ability to explore a wider range of investment options. Different custodians offer various investment choices, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate investment trusts (REITs), and even alternative assets like precious metals or cryptocurrencies. Account holders can leverage these options to diversify their portfolio and potentially enhance their investment returns.

Analyzing Fees Associated with Direct IRA Transfers:

While direct IRA transfers offer significant benefits, it's essential to be mindful of associated fees. Some custodians may charge transfer fees or account setup fees, which can vary depending on the custodian and the complexity of the transfer. It is crucial to carefully review the fee structures of both the sending and receiving custodians to ensure a clear understanding of the costs involved.

When making a direct IRA transfer, fees can vary significantly depending on the custodian. It is recommended to review the fee structures of each institution carefully, to ensure a clear understanding of all associated costs. Common fees include transfer fees, processing fees, and administrative fees.

Account holders may be subject to other charges such as annual account maintenance fees. By researching the fees and charges of different custodians, you can find the most cost-effective option to optimize your retirement savings strategy.

Exploring Potential Risk Factors Involved in Using Direct IRA Transfers:

Like any financial transaction, direct IRA transfers come with inherent risk factors that individuals should be aware of. It is essential to conduct thorough research on the reputability, track record, and customer service quality of the custodians involved. Additionally, account holders should carefully review the terms and conditions, investment options, and fee structures of the receiving custodian to ensure they align with their financial goals and risk tolerance.

Conclusion:

Direct IRA transfers offer a convenient and tax-efficient method for individuals to transfer funds between IRAs while preserving the benefits of the retirement account structure. By understanding the process, exploring the available investment options, and being mindful of associated fees and risks, account holders can leverage direct IRA transfers to optimize their retirement savings strategy.

FAQs:

Are direct IRA transfers taxable?

No, direct IRA transfers are not taxable. They allow funds to be moved between IRAs without incurring any tax consequences or penalties.

Can I transfer funds from a traditional IRA to a Roth IRA through a direct transfer?

Yes, you can transfer funds from a traditional IRA to a Roth IRA through a direct transfer. However, depending on the amount of the transfer, taxes may be due when the funds are withdrawn from the Roth IRA.

How long does a direct IRA transfer take?

The timeline for direct IRA transfers can vary depending on the custodians involved and the complexity of the transfer. In general, transfers can take anywhere from a few days to a few weeks to complete.

-

Pros in the Field of Investment Fund Management

Dec 29, 2021

-

Comparison between Medicaid and Long Term Care Insurance

Aug 03, 2022

-

A Guide to Selling a House with Solar Panels

Jul 03, 2023

-

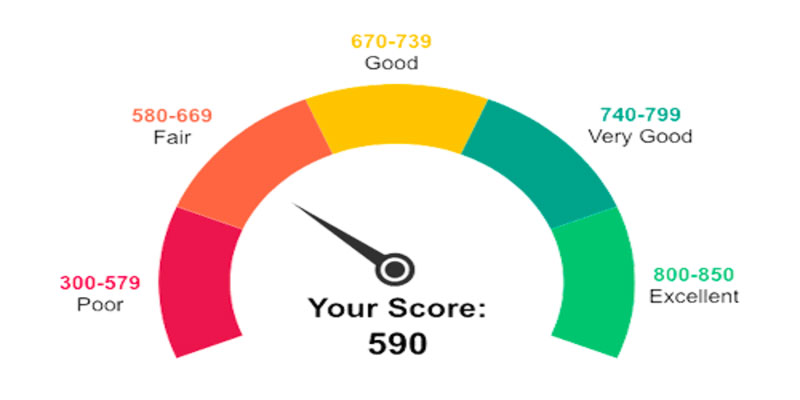

Is It Reasonable To Have A Credit Score Of 590?

May 25, 2023

-

A Guide about Flood Claims Adjuster

Dec 31, 2021

-

These 5 Factors Have Caused Cable TV's Demise

Aug 16, 2022

-

The 6 Great Financial Gifts For Kids This Christmas

Aug 08, 2022

-

What Makes a Good Realtor

Jul 04, 2023