May 25, 2023 By Triston Martin

Property owners can avoid the stress and expense of dealing with sewer line problems by purchasing sewer line insurance. Most ordinary homeowners' insurance plans cover property damage, but issues with the sewer line are typically not. do you need line insurance foe water and sewer Homeowners may question whether or not they need sewage line insurance in light of the potential dangers and associated costs.

Clogged drains, backed-up sewer lines, and leaking pipes are just a few examples of how problems with the sewage system can result in costly repairs, health dangers, and other unpleasant consequences. This article will discuss the value of sewage line insurance, the many coverage options available, the possible prices, and other considerations that should be considered before making a purchase. Homeowners may safeguard their properties, wallets, and mental health by weighing the pros and cons of several options.

Problems With Sewer Lines

Problems with a property's sewer line can have severe consequences for the health and safety of those living or working there. Debris and tree roots commonly cause blockages, old pipelines, and poor installation. It's critical to spot the warning indications of sewer line problems quickly so they may be fixed.

Signs of a problem with your sewer line include a foul odor, sluggish drains, gurgling sounds, sewage backups, and soggy patches in your yard. Damage to property, potential health risks, and expensive repairs might come from ignoring these warning signs. Homeowners can avoid or lessen the severity of sewage line problems by prioritizing routine maintenance, responding quickly to issues, and scheduling professional inspections.

Limitations Of Standard Homeowners Insurance

Standard homeowner's insurance is essential for many sorts of property damage, but it does not cover problems with sewer lines. To assess their risk and decide whether additional coverage is necessary, homeowners must understand these restrictions. Key restrictions of the typical house insurance policy are as follows:

Exclusions For Gradual Damage

Damage that occurs gradually, such as that caused by wear and tear or a lack of maintenance, is often not covered by a standard policy. Sewer line problems, such as clogs or leaks, typically develop over time and may not be covered by standard insurance policies.

The Absence Of A Maintenance Plan

The homeowner's responsible for keeping the sewer pipes in good working order. Standard insurance may not pay for damage or repairs to a sewer line if it is determined that the problem resulted from inadequate maintenance, such as failing to address clogs or maintain the pipes.

Limited Water And Sewer Backup Coverage

While water and sewer backups may be covered by homeowners insurance, the extent of that coverage is generally limited by lower coverage limits or higher deductibles. To protect against these dangers adequately, homeowners may need additional coverage, such as a water and sewer backup endorsement.

Pre-Existing Conditions That Aren't Covered

A standard homeowner's insurance policy only covers problems with the sewer line. A homeowner's insurance claim may be rejected if a problem with the sewer line occurred before the policy was in effect.

The Advantages Of Sewer Line Insurance

You need specialized coverage for sewer line problems, and do you need sewer line insurance that's precisely what you get with sewer line insurance. It helps offset the price of repairs, compensate for property loss, and cut down on out-of-pocket expenditures. As a bonus, it eliminates any dangers to residents' health caused by clogged drains. Additional living expenses and the availability of prolonged coverage may be provided by sewer line insurance. It's an excellent resource for homeowners because it covers problems with their sewer lines and gives them peace of mind.

Comprehensive Protection

Clogs, backups, and leaks are just some issues sewage line insurance covers. This protection goes above and beyond the scope of typical homeowner's insurance.

Comprehensive Protection

The diagnosis, repair, or replacement of broken sewer lines and any property damage or cleanup fees are often covered by sewer line insurance.

Peace Of Mind

In the event of costly and inconvenient sewage line problems, residents may rest easy knowing they are protected by specialized insurance.

Conclusion

Consider your property's age and condition, financial situation, and level of comfort with risk while making this decision. Insurance benefits many households because sewer line problems can cause significant financial difficulties and health dangers. It offers specialized protection, financial security, and peace of mind in case of sewage line issues such as blockages, backups, or leaks.

A well-informed choice can be made after carefully considering the probable expenses of repairs and property damage and regular homeowners insurance coverage restrictions. Sewer line insurance may be essential to protect your property, finances, and overall well-being. Consulting with insurance pros and evaluating coverage alternatives can provide clarity and help you make this determination.

-

Definition of bond futures

Jul 28, 2022

-

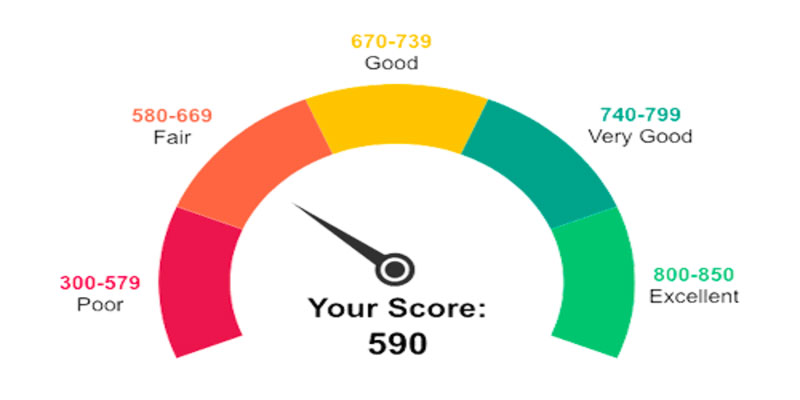

Is It Reasonable To Have A Credit Score Of 590?

May 25, 2023

-

How Much Are HOA Fees

Jul 02, 2023

-

How to Apply for a Home Loan

Jun 14, 2023

-

Can You Use Rent to Pay Your Mortgage

Jul 01, 2023

-

Why Should You Purchase Sewer Line Insurance?

May 25, 2023

-

Best Business Credit Cards For Bad Credit

Aug 25, 2023

-

Private Vs. Federal College Loans: A Comparison in 2022

Mar 13, 2022