Jul 28, 2022 By Susan Kelly

Bond futures is a financial derivative that requires the contact holder to buy and sell a specific number of bonds as stated in the contract agreement at a price that has been defined by the contract holder, with the exchange acting as the other party. It can be purchased and sold on the exchange market, and the price and due dates are set at the time the holder agrees.

Explanation

An agreement between two parties is referred to as a futures contract. An underlying asset is agreed to be purchased by one party and sold by the other at a defined price on a future date. A futures contract's underlying asset may be a financial asset, such as a bond or a commodity.

Bond futures are contracts in which the delivery asset is a Treasury or government bond. The futures markets standardize bond futures, which are among the most liquid financial products. A market that is liquid has a large number of buyers and sellers, which permits unhindered exchanges to occur.

In a Bond Futures contract, two counterparties agree on a price at which the party on the long side—the buyer—would buy the bond from the seller, who has the choice of which bond to deliver and when. Consider a situation where one party, the seller, is required to deliver a 30-year Treasury bond to the buyer on the designated day.

Both are holding a Bond Futures contract until it matures, and closing it out before that date is an option. Depending on the value of the futures contract at the time of the closing trade, the position will result in a profit or a loss if the person who opened it closes out before maturity.

Who can use Bond Futures?

Hedgers use bond Futures to safeguard an existing portfolio from unfavorable changes in interest rates.

- Hedgers can use Futures to protect the value of the underlying Spot Bonds since they have a genuine interest in them.

- Arbitrageurs make money from price differences between comparable goods on several marketplaces, such as the price difference between Spot Bonds and Futures.

- Investors can use Bond Futures to improve a portfolio of assets' long-term performance.

- Speculators can use Bond Futures to profit from quick price changes.

How do Bond Futures work?

Where to Trade Bond Futures

The Chicago Board of Trade (CBOT), a division of the Chicago Mercantile Exchange, is where bond futures are primarily traded (CME). Contracts usually end in March, June, September, and December each year. Underlying assets for Bond Futures include, for instance:

- Treasury bills for 13 weeks (T-bills)

- 2-, 3-, 4-, and 10-year Treasury notes (T-notes)

- Ultra and conventional Treasury bonds (T-bonds)

The Commodity Futures Trading Commission (CFTC) is the regulatory body in charge of overseeing Bond Futures. The CFTC's responsibilities include preventing fraud and ensuring fair trading procedures, equality, and market consistency.

Bond Futures Investing

A Bond Futures contract enables a trader to predict the price movement of a bond and secure a price for a predetermined future period. A trader would profit if they purchased a bond futures contract and the bond's price increased and closed higher than the contract price at expiration. At that point, the trader might either accept delivery of the bond or unwind the position by offsetting the buy order with a sell deal, with the net difference between the prices being settled in cash.

On the other hand, a trader could sell a Bond Futures contract in the anticipation that the bond's value will drop before the expiration date. The gain or loss might once again be net settled through the trader's account if an offsetting deal was entered before expiry.

Conversion factors for Bonds

The conversion factors used to standardize the exchange's standards determine the bonds that can be delivered. All delivery bonds' discrepancies in coupon and accumulated interest are balanced using the conversion factor. The interest that has been earned but has not yet been paid is known as accrued interest.

The conversion factor will be the following if a contract states that a bond has a notional coupon of 6 percent:

Bonds having a coupon lower than 6% would have a value of less than one.

more than one for bonds with a coupon rate greater than 6%

The exchange will make each bond's conversion factor public before a contract's trading takes place.

How are Bond Futures priced?

Since Bond prices can change significantly over time due to a variety of factors, such as changing interest rates, market demand for bonds, and economic conditions, Bond Futures have the potential to produce significant profits. Bond price changes, however, can have a double-edged effect, putting traders at risk of losing a sizeable percentage of their investment.

Bond futures' price on the expiration date can be calculated as follows:

Price = Accrued Interest + (Bond Futures Price x Conversion Factor)

The forward price offered in the futures market results from the conversion factor and the Bond's Futures price.

Example of Bond Futures

Let's take an example where a trader bought a Bond Futures contract for two years. The face value of the contract is $80,000, and the initial deposit for the deal was $4000. The bond is currently at $40, which represents a $160,000 future position.

The bond's value decreases as it approaches its expiration date and is currently valued at $38, or $152,000. This indicates that the trader will be responsible for an $8000 loss. The price discrepancy is paid in cash using the investor's brokerage account.

Bottom line

Bond Futures obliges the contract holder to purchase or sell the bond at a predetermined price and on a specific date. Bond futures are for investors who seek to safeguard or hedge their current portfolio against adverse interest rate movements. Before investing in futures, it's crucial to weigh the advantages and disadvantages and inquire with your brokerage about any particular rules.

-

What Makes a Good Realtor

Jul 04, 2023

-

Definition of bond futures

Jul 28, 2022

-

Accounts Receivable Software Review

Dec 06, 2021

-

Popular Investment Trends Right Now

Aug 22, 2023

-

Mastering the Art of Saving for Medical Expenses with an HSA

Aug 28, 2023

-

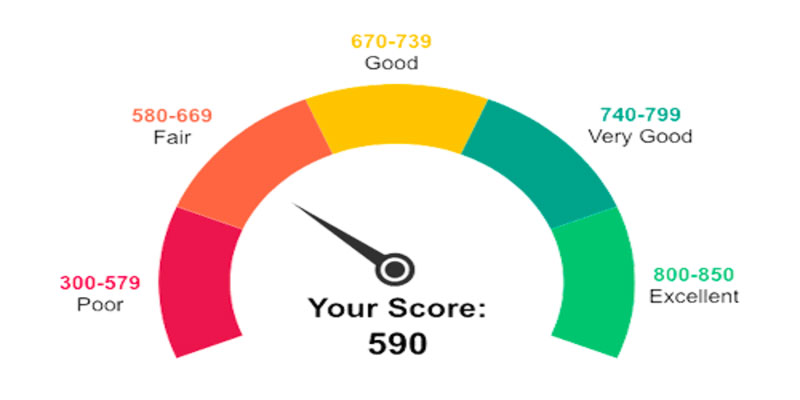

Is It Reasonable To Have A Credit Score Of 590?

May 25, 2023

-

How Direct IRA Transfers Work: A Comprehensive Guide

Jun 29, 2023

-

Converting Your IRA Into a Health Savings Account

Aug 12, 2022